can you opt out of washington state long-term care tax

The agent will be charged back and will lose money to sell your policy to you. After months of backlash governor Jay Inslee recently signed a pair of bills to delay and amend the tax for Washingtons long-term care.

Ten Things You Need To Know About Washington State S New Mandatory Long Term Care Tax Pacific Asset Management

People who work in Washington will pay 058 of their earnings into the Washington Cares Fund.

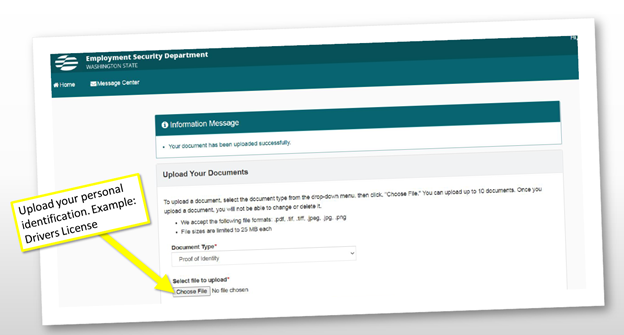

. To opt out you will need to purchase your own long-term care insurance policy as well as file a waiver application with the state between October 1 2021 and December 31 2022 for. Washington states Long-Term Care Trust Act is set to take effect at the beginning of 2022 and the only time to opt out of the new tax is fast approaching. Under current law Washington residents have one opportunity to opt out of this tax.

On January 27 2022 Washington Governor Jay Inslee signed House Bills 1732 and 1733 delaying and amending the Washington Cares Act often referred to as the Long-Term. The Washington Long-Term Care Act is still the law. How do I opt out of WA cares.

Lets assume for the moment that you dont opt-out of the Washington long-term care tax program before the December 31 2022 deadline. Be sure to privately take care of the insurance agent that helps you. The window to apply for an exemption.

26 2021 inviting passersby to come in and ask questions about. Private insurers may deny coverage based on age or health status. The video below will walk you through.

Yes you can do this. You have one opportunity to opt out of the program by having a long-term care insurance policy in place by November 1 st 2021. If you purchased a long-term care insurance policy prior to November 1 2021 then you have the golden ticket to remain exempt.

Turns out they were a bit premature. No matter your age or health status the WA Cares Fund provides affordable long-term care coverage. If you meet the opt-out criteria and purchased your LTC policy prior to Nov 1 2021 you have until December 31 2022 to opt-out of the tax.

In that case the tax will be. Applications are available as of October 1 2021. Long-term care insurance companies have temporarily halted sales in Washington.

Washington has adopted a first-of-its-kind law that both provides a new long-term care benefit and pays for the new benefit with a new tax collected by employers. Opting out of the tax must be done by November 1 2021 and you must buy qualified private long-term care. To qualify for an exemption you must be at least 18 years old and have proof of an eligible LTC.

My phone is ringing. Monday is the deadline to have your private long-term care insurance plan in place in order to opt out of Washingtons new payroll tax. One last catch if you end up retiring in outside of Washington State all the LTC benefits you paid into are void and not.

Here is a summary of the bill. 1 to opt out of the states long-term care. The move follows a frenzy of interest in the costly insurance policies prompted by a November.

For example if someone earns 100000 they will. A sandwich board sits outside an insurance brokers office in Seattles Fremont neighborhood on Aug. Once you opt-out you can never opt back in which is a good thing.

Washington S Long Term Care Payroll Tax And How To Opt Out Alterra Advisors

Thousands Of Washingtonians Look To Opt Out Of Long Term Care Insurance Tax Business Daily News Mcknight S Senior Living

Ltc Insurance What Is The Long Term Care Tax In Washington State King5 Com

Washington Long Term Care Tax How To Opt Out To Avoid Taxes

Pause On Long Term Care Tax Passes Through Washington House King5 Com

Repealing The Unpopular Long Term Care Insurance Program And Regressive Payroll Tax Washington State House Republicans

Washington Long Term Care Trust Act Life Insurance Medicare Long Term Care Retirement Planning Medicaid Planning

Washington State Long Term Care Tax How To Opt Out

The Washington State Long Term Care Trust Act Opt Out Is Now Available Online Parker Smith Feek Business Insurance Employee Benefits Surety

How Do You Opt Out Of Washington State S Long Term Care Tax Avier Wealth Advisors

It S Coming More Employee Tax News Goldendalesentinel Com

Multiple States Considering Implementing Long Term Care Tax Ltc News

Wa Cares Exemption How To Opt Out Of The Tax Brighton Jones

What You Need To Know About Washington State S Public Long Term Care Insurance Program

Washington State Long Term Care Trust Act 0 58 Payroll Tax 36 500 Lifetime Maximum Benefit Page 8 Bogleheads Org

Washington Lawmakers Look At Long Term Care Program As Frustration Builds Over Benefits And Payroll Tax The Seattle Times

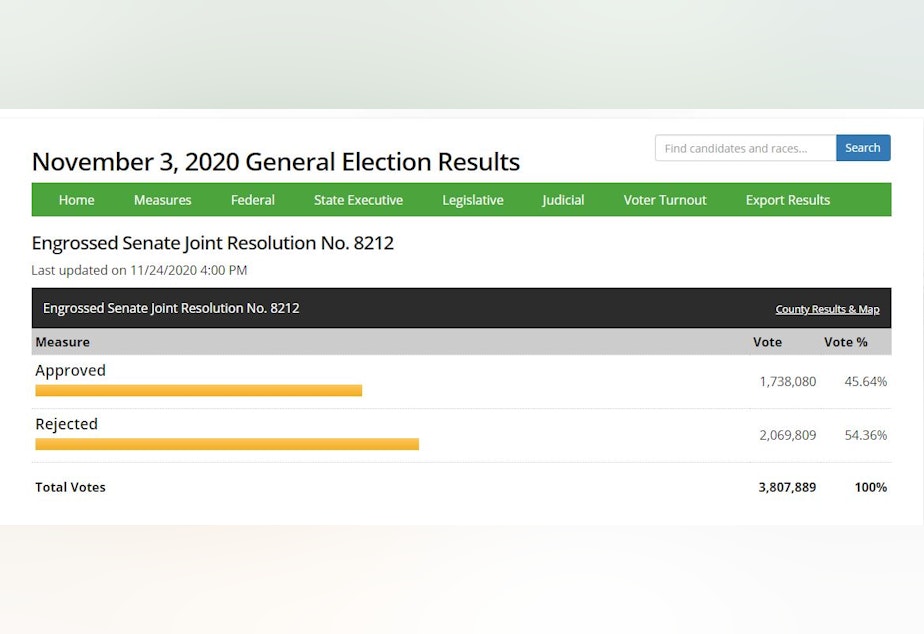

Kuow Wa Voters Said No Now There S A 15 Billion Problem