does california have an estate tax or inheritance tax

There are only 6 states in the country that actually impose an inheritance tax. The information below summarizes the filing requirements for Estate Inheritance andor Gift Tax.

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Inheritance Tax In California.

. California also does not have an inheritance tax. However California is not among them. The exemption amount will rise to 51 million in 2020 71 million in 2021 91 million in 2022 and is scheduled to match the federal amount in 2023.

117 million increasing to 1206 million for deaths that occur in 2022. If the property you left behind to your heirs exceeds your lifetime gift and estate tax exemption of 117 million in 2021 or 1206 million for 2022 youd owe a federal estate tax on the portion that exceeds those thresholds. Thats why planning out your estate ahead of time is of paramount concern.

For a home owned this long the inheritance exclusion reduces the childs property tax bill by 3000 to 4000 per year. States California doesnt have an inheritance tax meaning that if youre a beneficiary you wont have to pay tax on your inheritance. Inheritance and Estate Tax and Inheritance and Estate Tax Exemption California does not have an inheritance or estate tax.

But the good news is that California does not assess an inheritance tax against its residents. California is one of the 38 states that does not have an estate tax. Maryland is the only state to impose both.

California does not have an inheritance tax. The top estate tax rate is 12 percent and is capped at 15 million exemption threshold. Like most US.

The estate tax is paid by the estate. While an estate tax is charged against the deceased persons estate regardless of who inherits what states with an inheritance tax assess it on the beneficiary. Inheritance taxes where they apply are levied on a personal level after the estate has been distributed.

Does California Impose an Inheritance Tax. Keep reading as Financial Planner LA explains what you need to know about inheritances and estate taxes in California. An inheritance tax is a tax issued on people who either own property in the state where they passed away also called an estate tax or people who inherit property from a residence of that state called an inheritance tax.

California is part of the 38 states that dont impose their own estate tax on inheritances. However there are other taxes that may apply to your wealth and property after you die. With the exception of the estate tax for estates exceeding 1158 million dollars per person California does not have a state-level inheritance tax.

100 Accurate Expert Approved Guarantee. If you are a beneficiary you do not have to pay taxes on your inheritance. Its not paid by you the beneficiary.

California property owners are getting older. If you think youll need help with estate planning a financial advisor could advise you on reaching your goals. For decedents that die on or after January 1 2005 there is no longer a requirement to file a California Estate Tax Return.

There is no state-level inheritance tax in California except for real estate taxes on real estate in excess of 1158 million per person. This is huge for my California financial-planning clients. Get Your Taxes Done Right With Support From An Experienced TurboTax Tax Expert Online.

No estate tax or inheritance tax Connecticut. Most states have been moving away from estate or inheritance taxes or have raised their exemption levels as. That being said California does not have an inheritance tax.

As of 2021 12 states plus the District of Columbia impose an estate tax. Ad TurboTax Tax Experts Are On Demand To Help. Generally inheritance is not taxed in California.

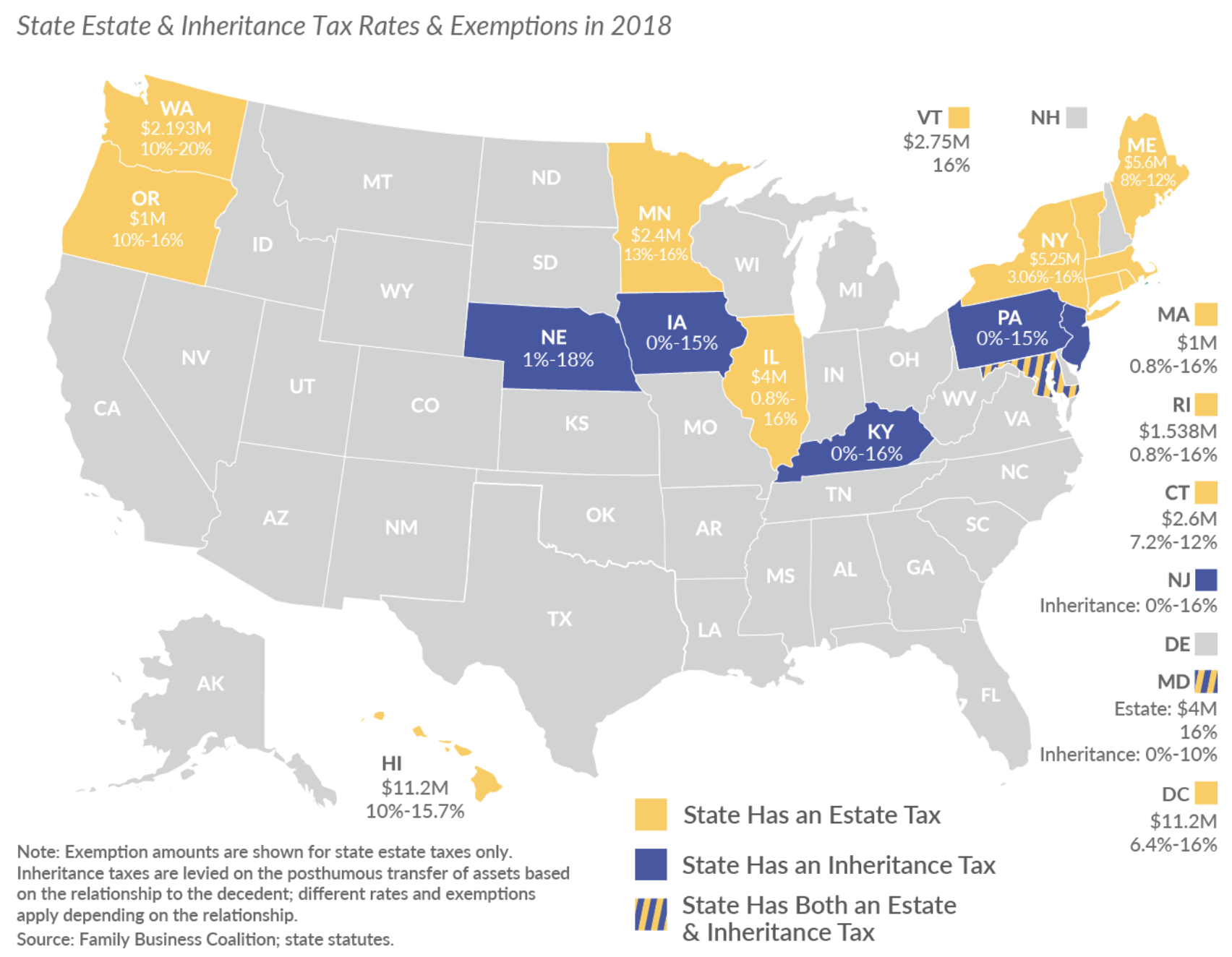

In fact just six states do Iowa Kentucky Maryland Nebraska New Jersey and Pennsylvania. There are no estate or inheritance taxes in California. This does not necessarily mean that your inheritance will be tax-free.

Only 11 states do have one enacted. 4 The federal government does not impose an inheritance tax. A federal estate tax is in effect as of 2021 but the exemption is significant.

California does not have an estate tax so probate is generally spent verifying the validity of the will and confirming who will act as executor of the estate. Under the current tax rules you have to have an estate in excess of 11 million per person before youre going to be subject to estate tax. That is not true in every state.

Twelve states and Washington DC. The California Inheritance Tax and Gift Tax As I previously mentioned there is no inheritance tax in California regardless of net worth. If you inherit money you will not have to pay a tax on the amount you.

Impose estate taxes and six impose inheritance taxes. California inheritance laws especially when there isnt a valid will in place can get a bit convoluted. It is typically assessed by the state where the beneficiary or heir lives and resides.

And although a deceased individuals estate is usually responsible for the payment of estate taxes a decedents beneficiaries are responsible for the payment of inheritance taxes. The share of homeowners over 65 increased from 24 percent in 2005 to 31 percent in 2015. When you receive your inheritance there really isnt any income tax.

Individuals unrelated to a deceased person however tend to be subject to inheritance tax. For decedents that die on or after June 8 1982 and before January 1 2005 a California Estate Tax Return is required to be filed with the State Controllers Office if. Some states have enacted inheritance taxes on estates of any size.

In addition to the federal estate tax with a top rate of 40 percent some states levy an additional estate or inheritance tax. Seventeen states have estate taxes but California does not. People often use the terms estate tax and inheritance tax interchangeably when in fact they are distinct types of taxation.

California does not impose an inheritance tax. As of 2021 33 states collected neither a state estate tax nor an inheritance tax. Number of Inherited Properties Likely to Grow.

Does California Have a State Level Inheritance Tax. Certain states only impose an inheritance tax.

California Estate Tax Everything You Need To Know Smartasset

Inheritance Tax How It Works How Much It Is Bankrate

States With No Estate Tax Or Inheritance Tax Plan Where You Die

States With No Estate Tax Or Inheritance Tax Plan Where You Die

What Is An Estate Tax Napkin Finance

The Estate Tax On Stocks And Dividends Intelligent Income By Simply Safe Dividends

/estate_taxes_who_pays_what_and_how_much-5bfc342146e0fb00265d85b5.jpg)

Estate Taxes Who Pays And How Much

How Is Tax Liability Calculated Common Tax Questions Answered

Taxes On Your Inheritance In California Albertson Davidson Llp

What Is An Estate Tax Napkin Finance

How Do State Estate And Inheritance Taxes Work Tax Policy Center

How Much Is Inheritance Tax Community Tax

Taxes On Your Inheritance In California Albertson Davidson Llp

Is Inheritance Taxable In California California Trust Estate Probate Litigation

Estate Tax Examples Of Estate Tax Estate Tax Rate

A First Impression Of The Expatriation Inheritance Tax Sf Tax Counsel

California Estate Tax Everything You Need To Know Smartasset